Nike’s New Business Model Focusing on DTC: What Business Students Stand to Learn

If all companies’ business models stayed the same, they would fail. In recognition of the need to evolve and increase profits, Nike has undergone a dramatic change to how they do business

Just a few years ago, Nike announced a dramatic change to its overall business model. The change to the model, along with its resounding success, is an excellent example of the importance of innovation in business. It also highlights Nike’s extraordinary ability to create a world-recognized brand and maintain its status as an industry leader.

The Changes to the Business Model – In Summary

Historically, Nike has had some direct-to-consumer (DTC) sales but went on to focus primarily on wholesale. Recently, however, the company announced a planned shift to focus primarily on DTC sales.

A Closer Look at the Changes to the Business Model

For most of the company’s history, Nike has worked primarily with wholesalers. The brand had a fairly typical business model. They sold the products to wholesalers, who then displayed the products in their stores and sold them to customers. Wholesale partners included department stores, sporting goods stores, mom-and-pop shops, and more.

Now, it is incredibly difficult for wholesalers to work with Nike. The brand has gone all-in on a direct-to-consumer strategy which means that even wholesalers who worked with them for years can no longer buy the products. This has led to a significant shift in how people buy Nike shoes. Now, Nike primarily sells shoes to consumers via digital channels, such as its various apps and website. The company also has branded immersive stores.

Nike Combines DTC Experiences

Examining Nike’s DTC approaches shows a significant amount of overlap. Like most brands, there are both digital solutions, like the website and apps, and physical locations. But Nike has taken the integration of technology and the digital experience in stores to the next level.

Specifically, Nike gives in-store shoppers multiple ways to use their phones to improve the shopping experience. They can start a dressing room or pull up products on their phones. To streamline the new customer experience, Nike also has signs throughout its stores highlighting the various smartphone-connected in-store features.

How Wholesalers and Stores Are Adapting

Stores that used to rely on Nike for a significant amount of their income had to think quickly to determine a way to keep selling the products or fill the gap. For many stores, the only option to stock Nikes became doing so “on consignment.” With this model, the stores themselves do not own the shoes. They are owned by someone else who consigns the shoes to the store. When sold, the store takes a cut of the profit, but the owner of the shoes makes the bulk of the money. There are obvious complications with this new consignment option. For one, it makes it much more challenging for stores to offer Nikes at all, let alone a variety of them. Stores may have to work with multiple people who want to consign their shoes and those people can’t buy the shoes wholesale either.

On top of that, the process cuts into the profit margins of the stores. They can still ultimately control their profits via the price of the shoes, but they have to increase the prices to make the same profit they had previously made as wholesalers. The owner of the shoes who consigns them to the store is essentially another middleman in the process, meaning another cut of the profit is taken out.

Learn how to develop the most in-demand skills for your future career!

Discover how you can acquire the most in-demand skills with our free report, and open the doors to a successful career.

The Role of Influencers

With the new DTC approach, social media influencers play a larger role in Nike’s overall approach. They become a key part of the brand’s marketing as influencer-created content reaches consumers. On top of that, Nike works with some social media influencers like they previously worked with wholesale retailers. For that part of the relationship, Nike largely determines which influencers to sell to based on audience size and reach.

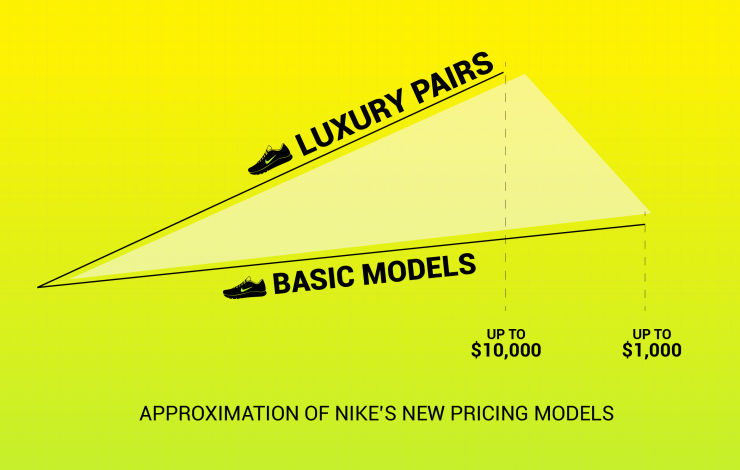

The Effect on Prices

For consumers who buy shoes directly from Nike, as is the brand’s goal, there is not necessarily a dramatic change in the prices. However, many shoes are now in high demand. This lets Nike sell them for more, but it also means that shoppers must act fast if they want a particular shoe.

That scarcity, combined with the consignment model many stores are using, has driven prices up. The fact that shoes in stores now feature an extra middleman (the owner who consigns them) has also driven prices up. In fact, some basic models can now reach $1,000 or multiples of that for a single pair. It is not hard to find a pair selling for $10,000 or more.

The Effect on Shoppers

In addition to the rising prices, this change means that Nike buyers will find themselves with limited options for trying the shoes on. This is especially true given that in many stores that sell the shoes on consignment, the sneakers are wrapped in plastic.

Other Key Elements of the Consumer Direct Offense

The Consumer Direct Offense strategy from Nike is a well-rounded approach that involves more than the transition to DTC. It also includes accelerating innovation and the creation of products. It features expanding operations in 12 strategic cities in ten countries as a way to move physically closer to consumers. Finally, it aims to deepen the one-on-one connections with customers by creating more interactive experiences.

Consumer Direct Acceleration Further Emphasizes the DTC Priority

Nike followed up its Consumer Direct Offense in 2020 with the Consumer Direct Acceleration. This began with the creation of a connected digital marketplace for a seamless brand experience. It includes Nike’s store concepts, including the Nike House of Innovation, Nike Unite, Nike Live, and Nike Rise. The common theme is that Nike aims to connect digital services with offline ones.

This Consumer Direct Acceleration also includes more straightforward categories for kids, women, and men. It also features aggressive digital investment. Since announcing the initiative, Nike has invested in demand sensing, inventory management, and insight gathering.

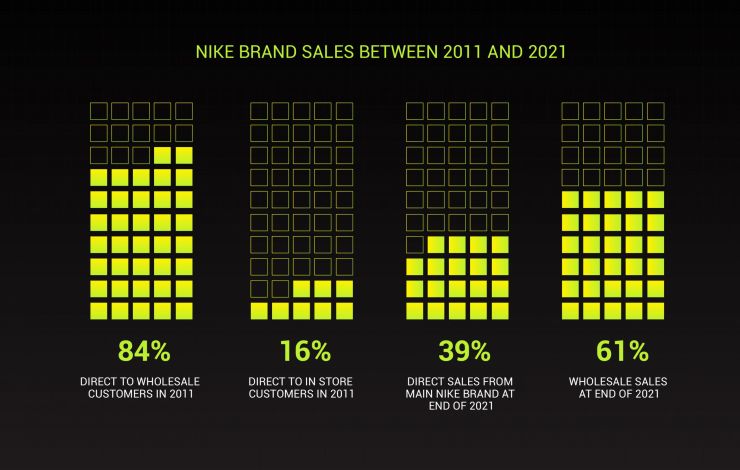

The Extent of the Shift from Wholesalers to DTC

Simply stating that Nike has decided to shift its business model to focus more on DTC than wholesalers is not enough. It doesn’t accurately show the extreme degree to which the shift occurred. The changes began in 2017 when the brand announced a “consumer direct offense.”

A better point of comparison is to look at Nike brand sales in 2011 and again for the 2021 fiscal year. In 2011, 84% of the sales were to wholesale customers. The remaining 16% were direct to customers in Nike stores and via its website. By the end of the 2021 fiscal year, direct sales (from the main Nike brand) were up to 39%. Wholesale sales were at around 61%.

More recent figures show that the focus on DTC continues to be a success. Figures from the most recent three-month period ending on February 28th confirm this. During that time, Nike had a 17% increase in direct-to-consumer sales. Those DTC sales accounted for 42.3% of Nike’s overall revenue for the fiscal third quarter.

Nike Is Still Working with Certain Wholesalers

While Nike has shifted its focus on direct-to-consumer sales, the brand still works with some wholesalers. According to Nike, the focus is on “compelling local neighborhood partners” with connections to sports performance and lifestyle. This includes some of the brand’s larger strategic partners, such as JD Sports, Foot Locker, and Dick’s Sporting Goods. The brand also still works closely with local skate shops.

In practical terms, Nike is only working with retailers that feature it prominently and make the brand seem special. Even then, Nike will not work with every retailer that does this.

The Future of the Transition

If Nike’s plan remains on track, direct sales will account for 60% of its business by 2025. This figure will include digital sales.

For reference, the original goal was to hit 30% digital penetration by 2023. In this case, digital penetration refers to 30% of the total sales being e-commerce revenue from Nike. But the brand achieved that in 2021. This was then replaced with a goal of 50% digital penetration for 2022.

Learn how to develop the most in-demand skills for your future career!

Discover how you can acquire the most in-demand skills with our free report, and open the doors to a successful career.

Reasons for the Shifting Business Model

When Nike announced its “consumer direct offense” in 2017, it highlighted some of the reasons it chose to change strategies.

Direct Sales Boost Profits

One of the likely reasons for the push on direct sales is that it improves the profit margins. With direct sales, there is no middleman taking a cut of Nike’s profits.

The fact that direct-to-consumer sales boost profits is well-known. This is why so many startups follow the model.

Connections to Customers and Customer Data

By focusing on direct sales, Nike also collects data on its customers directly. This can be useful for marketing. Direct sales also mean that Nike has direct contact with customers, something that can also be helpful for marketing as well as customer service.

Nike Has More Control

The other key factor is that focusing on direct sales lets Nike control its brand. By contrast, Nike doesn’t have much control over what retailers do with its products after buying them. They could just place Nike shoeboxes with competitors or in a way that the brand doesn’t prefer. Some experts believe that this lack of control is why Nike decided not to continue working with Amazon.

DTC Trends During the Pandemic

Estimates indicate that the pandemic caused an overall market shift toward direct-to-consumer sales. Of course, these were not on the same level as Nike’s efforts. Research from McKinsey and the World Federation Sporting Goods Industry reported on the shift. Researchers suggest companies aim for at least 20% of their business to be direct-to-consumer. Nike was clearly ahead of the curve with this trend.

Other businesses have since started following the trend led by Nike. For example, Under Armour wants half of its sales to be direct-to-consumer by 2025. Under Armour is on a similar track, closing relationships with thousands of wholesalers.

The Successful Change Highlights Nike’s Brand Power

Sales figures show that the changing strategy has worked well for Nike. According to Nike, digital sales via websites and apps increased by 22%. This included a 33% growth within North America, which led the area. This is especially impressive when compared with the growth figures for other brands and retailers.

Another indication that Nike is on the right track with its innovative strategy is its overall sales. Sales in 2021 for DTC reached $16.4 billion. The trailing 12 months saw $46.2 billion of total sales.

To provide a point of comparison between Nike’s success and that of other brands, consider the figures at the end of fiscal 2020. Nike had revenue of $35.6 billion, $37.4 billion across the company. By contrast, Under Armour only made $4.5 billion in that time, and Adidas made $23.8 billion.

The impressive growth that Nike has achieved with the change highlights not only the company’s innovation but also its brand power. A direct-to-consumer approach cannot take advantage of the marketing from retailers; it must rely on the brand’s own marketing and name power. Nike certainly has this, as it is among the best-known and most popular sneaker companies in the world.

What Nexford MBA Students Stand to Learn

Whether you are studying for a Nexford MBA or an undergraduate business degree, there are some important insights to learn from Nike’s successful changes.

Reinvent to Adjust to Market Conditions

Nike examined the market and noticed that it was time for a change. The company recognized that the demands of consumers were changing, as were the technologies and opportunities available. Nike adapted to these changing market conditions.

Business students of Nexford University can learn the same thing. You must be willing to reinvent yourself when necessary to adjust to changes in the job market. Reinventing yourself and searching for improvement provides a way to stand out from other candidates in a job search.

How to Translate Reinvention into Your Business Life

For Nike, reinvention and adaptation meant changing the balance between wholesale and DTC sales. For business students or anyone in search of career advancements, this can be continuous learning. Lifelong learning at Nexford allows you to improve your skill sets. Each new skill set that you acquire is a way to reinvent yourself and stand out in the market.

Conclusion

Several years ago, Nike announced a transition from focusing on wholesale customers to direct-to-consumer sales. The transition has gone smoothly and is leading the brand to success. MBA students at Nexford can use Nike as inspiration and work to constantly improve themselves. Expanding your skill sets is your personal version of Nike adapting to the changing market demands.

Ready to take the next step? Download our brochure or book a call with our Nexford Advisors!

Nexford’s staff writers help you make the most of your university experience.

We’re based in the US and have teams across the world, including in the UK, Africa and Asia.

Join our newsletter and be the first to receive news about our programs, events and articles.